Warrantage Inventory and Credit System

Summary

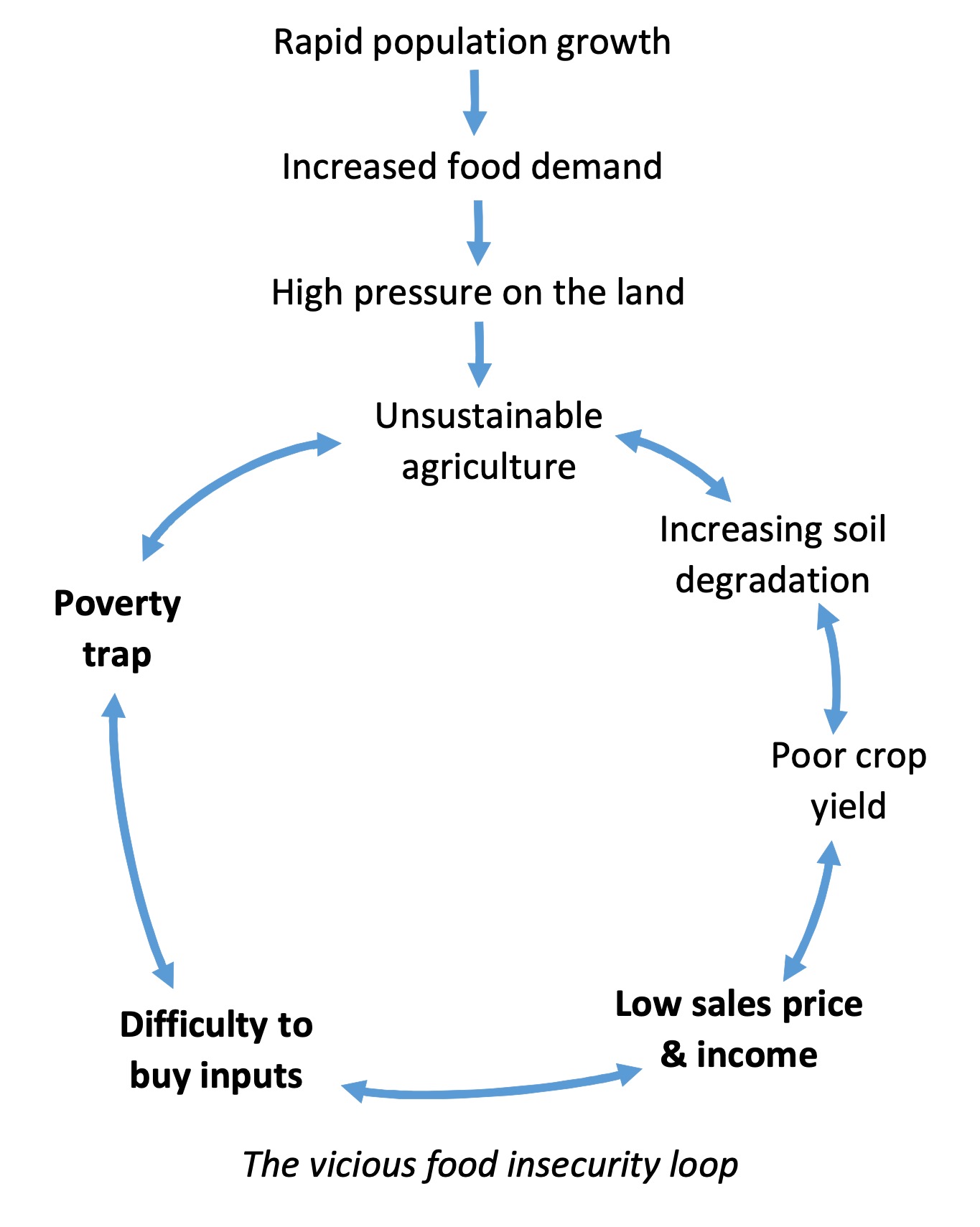

Limited access of small-scale farmers to favorable markets and reliable storage facilities is one of the key causes of food insecurity and pervasive poverty across millet and sorghum production areas. As a result, farmers are forced to sell their grain at peak production times for low prices. Later in the year, food prices increase but poorer households are unable to save their produce until then. Reduced income makes it difficult for farmers to purchase inputs for the next season without acquiring commercial loans, but these demand collateral that are difficult to meet. High interest rates set by commercial credit systems can lead to debt traps and food insecurity loops. In response, the warrantage inventory and credit system was designed to provide sustainable financing of investments in agricultural production across communities of small-scale farmers.

About the Solution

Warrantage is a warehouse receipt system that provides inventory credit for stored grain that is adapted to rural areas and smallholder families. It is limited to ‘non-perishable’ agricultural produce that have a track record of rising prices in the months following harvest such as millet, sorghum, and other grains. Through the inventory system, farmer organizations and their members obtain loans against the stored commodity that is gaining value during over the borrowing period. This security agreement governing the credit between Warrantage managers and depositors stipulates that in the event of non-payment by the farmers group, the financial partner will be entitled to sell the stored product to recover what is due. This allows the lender to avoid loss in the case of repayment failure, which drastically reduces risk and interest rates. Households acquire financial capacity without altering their household budget, since they benefit from the price differential between the time of harvest when produce is abundantly available and the dry season when there is short supply of food leading to higher prices. Loans enable households to address some urgent financial needs, engage in collective fertilizer and seed purchase, and start income-generating activities like fattening of small ruminants, vegetable gardening and small trading during the dry season.

Warrantage systems bypass intermediary traders without disrupting supply of wholesale and urban markets, and without hiking prices. The approach does burden farmer organizations with a large risk of post-harvest damage by insects and other pests. Warrantage credit systems are highly suitable for smallholder farming communities from Sub-Saharan African that lack favorable bank lending for agricultural investment and where debt leads to poverty and economic marginalization. In addition to being a cash management tool, the warrantage system also manages larger economic risk. This approach offers major benefits for millet and sorghum growing areas in semi-arid humid climates.

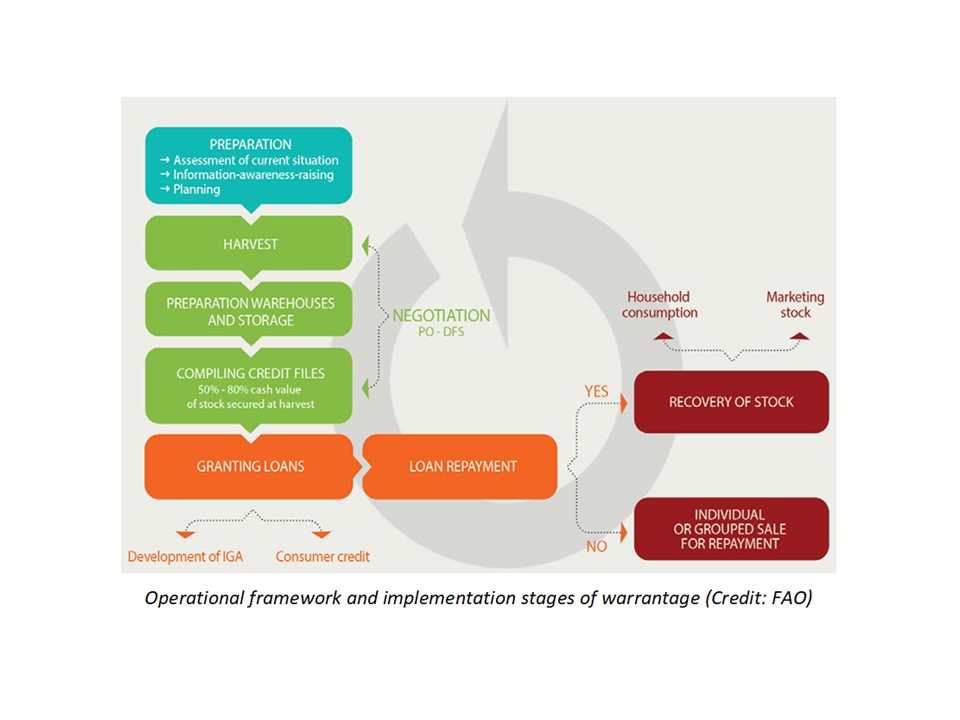

The main actors collaborating in the implementation of a warrantage operation are the umbrella farmer unions and federations, and the grassroots producer organizations and their members. These link with private lenders such as decentralized financial systems or public extension services. All these bodies have an “inventory credit committee” with a chair, a treasurer, and a warehouse manager. The inventory credit committee of the different grassroots producer organizations plays an active role in all stages of inventory credit, especially in the management of warehouses and their stored products. Those that do not own warehouses have to negotiate the hire premises. Inventory credit committees and their executive bureaus handle the general coordination, set the purchase price of products, negotiate, sign contracts with lenders and buyers, and distribute credit. They also support members in training, monitoring, accounting, and arbitration. Some unions and federations contribute to the financing of inventory credit from their own working capital.

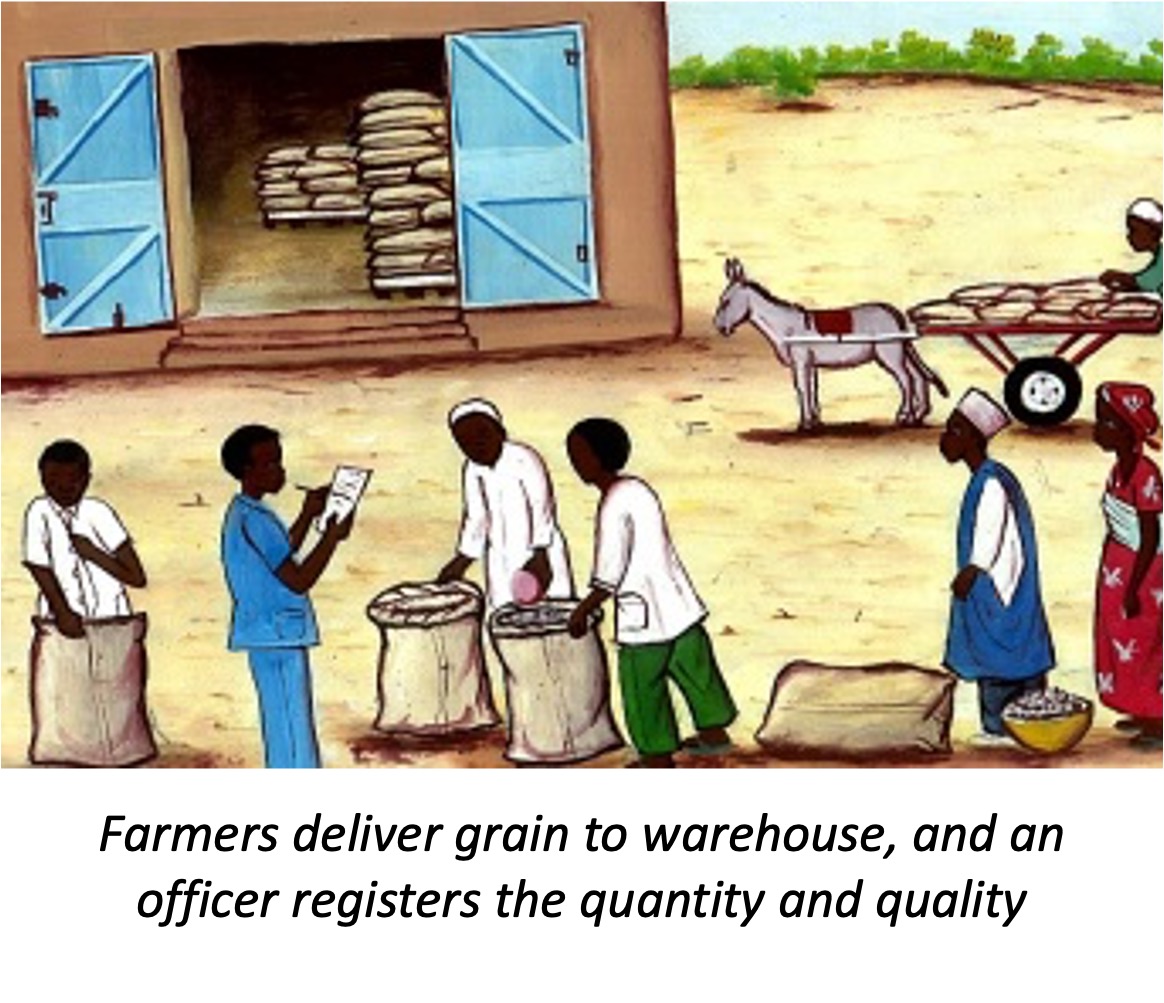

The operational framework to implement a warrantage inventory credit system involves several key steps. Just after harvest, a fair purchase price for farm produce is established during a meeting of the inventory credit committee and representatives of the grassroots organization. Prices follow local market rates. It is at this stage that detailed timetables for storage and withdrawal of stock are agreed upon. Once these arrangements have been made, the union requests a loan from a financier for the inventory operation. Prior to each harvest season, warehouses are cleaned and organized to receive the new stock. Each farmer arranges the transport of produce that he or she is placing under inventory. The operation is supervised by the inventory credit committee of grassroots producer organization who check and register the quality and weight of crops, and the packaging used. New sacks must be used to ensure optimal protection against pests and need to be distinguish each season’s produce. In the process, the inventory credit committee officers secure the warehouse. Grassroots producer organizations or farmer groups receive cash funds from the loan for distribution to its members. Warehouses are opened periodically during an inventory credit season by the producer organization and lender to check the condition of stored produced.

Commercialization

Commercially available

Solution Images

Institutions